Commodity trading has always been a race against time. Markets move fast, counterparties expect instant responses, and traders rely on accurate, real‑time insights to make profitable decisions. Yet, in many organizations, the pre‑deal process — the critical workflow before a trade is executed — remains slow, manual, and fragmented across emails, spreadsheets, and legacy systems.

Today, AI automation, GenAI tools, and modern digital mobile apps are reshaping this landscape. They’re not just improving efficiency; they’re redefining what a high‑performing front office looks like.

⚡ Why the Pre‑Deal Process Matters

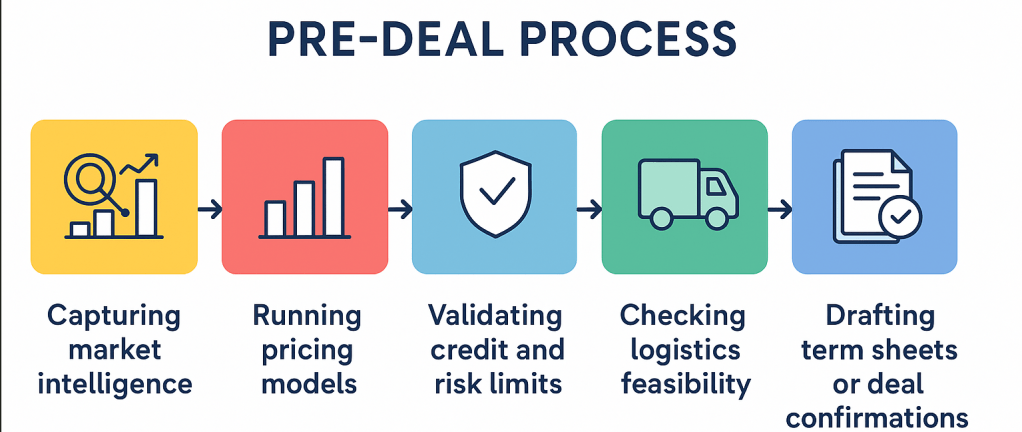

Before a trade is booked into a CTRM system, front‑office teams typically navigate a series of steps:

- Capturing market intelligence

- Running pricing models

- Validating credit and risk limits

- Checking logistics feasibility

- Coordinating with operations and finance

- Drafting term sheets or deal confirmations

- Getting approvals from management

Each step is essential — and each is vulnerable to delays, human error, and information silos.

In a volatile market, inefficiencies in the pre‑deal workflow can directly impact margins, risk exposure, and customer satisfaction.

🤖 The New Era: AI and Automation in Pre‑Deal Workflows

AI is no longer a futuristic add‑on. It’s becoming the backbone of modern CTRM front‑office operations.

1. Automated Market Intelligence & Price Discovery

AI can continuously monitor:

- Global price feeds

- Freight indices

- Weather patterns

- News sentiment

- Supply chain disruptions

Instead of analysts manually gathering data, AI delivers real‑time insights, alerts, and predictive price curves — giving traders a competitive edge.

2. Smart Deal Pricing & Scenario Modeling

GenAI‑powered pricing engines can:

- Auto‑populate forward curves

- Run multiple what‑if scenarios

- Suggest optimal hedging strategies

- Highlight margin risks instantly

This reduces dependency on spreadsheets and speeds up decision‑making.

3. Automated Credit & Risk Checks

AI can instantly validate:

- Counterparty credit limits

- Exposure across portfolios

- Historical performance

- Sanctions and compliance flags

What used to take hours can now be done in seconds.

4. AI‑Generated Term Sheets & Deal Documents

GenAI tools can draft:

- Term sheets

- Indicative quotes

- Deal confirmations

- Internal approval notes

All based on templates, past deals, and trader inputs — dramatically reducing administrative workload.

📱 Mobile Apps: The Front Office in Your Pocket

Modern trading teams are no longer tied to their desks. Mobile apps built around CTRM workflows are enabling:

1. On‑the‑Go Deal Capture

Traders can:

- Capture deal intents

- Run quick pricing

- Check positions

- Submit approvals

…all from a smartphone. i had built mobile apps that captures deal intents and helps to check positions instantly on the go.

2. Instant Collaboration

Mobile apps streamline communication between:

- Traders

- Risk teams

- Operations

- Finance

- Management

No more waiting for email chains or desktop access.

3. Real‑Time Alerts & Approvals

Push notifications ensure:

- Price movements

- Credit limit breaches

- Margin calls

- Approval requests

…are acted on immediately.

4. Digital Audit Trails

Every action — from pricing to approval — is logged automatically, improving governance and compliance.

🔄 Bringing It All Together: A Unified, AI‑Driven Pre‑Deal Ecosystem

When AI, GenAI, and mobile apps integrate seamlessly with a CTRM platform, the pre‑deal process becomes:

The result is a faster, smarter, and more controlled front‑office environment.

🌟 The Strategic Impact for Trading Organizations

Companies that modernize their pre‑deal workflows experience:

- Shorter deal cycles

- Higher trader productivity

- Reduced operational risk

- Better compliance and auditability

- Improved customer responsiveness

- Higher profitability through faster execution

In a market where milliseconds matter, this transformation isn’t optional — it’s a competitive necessity.

🧭 Final Thoughts

The pre‑deal process has long been the bottleneck in commodity trading. But with AI automation, GenAI tools, and mobile‑first workflows, front‑office teams can finally operate with the speed and intelligence the market demands.

Trading organizations that embrace this shift will not only streamline operations — they’ll redefine what excellence looks like in the digital age of commodity trading.