The world of commodity trading is in constant motion, driven by volatile markets, intricate logistics, and ever-evolving risks. For years, Commodity Trading and Risk Management (CTRM) systems have been the backbone of this industry, helping firms manage the complexities. But what if these systems could do more than just manage? What if they could predict, automate, and even generate new insights?

Welcome to the era of AI-powered CTRM.

No longer a futuristic concept, Artificial Intelligence is moving from the experimental lab into the operational heart of commodity trading. In 2026, the focus has shifted dramatically from simple price prediction to integrated, Agentic Workflows that automate and optimize the entire lifecycle of a trade.

Let’s dive into how AI is transforming the commodity trading business and reshaping CTRM applications.

1. Front-Office: Smarter Market Intelligence & Alpha Generation

The first place AI makes a splash is in discovering hidden opportunities. AI models are now capable of processing vast amounts of “alternative data” that was previously too noisy or complex for human analysts alone.

* Eyes in the Sky & IoT: Imagine AI analyzing satellite imagery to estimate global oil storage levels (by measuring shadows in floating roof tanks), predicting crop yields (using NDVI indices), or assessing port congestion—all in near real-time. This provides an unparalleled advantage.

* Decoding Sentiment: Large Language Models (LLMs) are scanning thousands of news articles, regulatory filings, and social media discussions to gauge market sentiment. This allows traders to anticipate shifts before they are reflected in price movements.

* Advanced Price Forecasting: Beyond traditional econometric models, AI employs sophisticated techniques like LSTMs (Long Short-Term Memory networks) and Transformers to forecast short-term price movements and basis risk with greater accuracy.

2. Middle-Office: Proactive Risk Management

Traditional CTRM systems often excel at recording and reporting what has happened. AI supercharges them to anticipate what could happen.

* Dynamic VaR (Value at Risk): Forget static historical simulations. AI uses Monte Carlo simulations enhanced by Generative AI to create “synthetic stress scenarios.” This means modeling unprecedented events—like a sudden geopolitical blockade—that have no historical precedent, providing a more robust view of potential losses.

* Counterparty Intelligence: AI continuously monitors the financial health of counterparties by scanning global news for “early warning” signals of distress (e.g., legal issues, payment delays). This allows firms to adjust exposure proactively, mitigating potential defaults.

* Anomaly & Fraud Detection: Machine Learning algorithms are constantly scanning trade patterns to flag unusual activity, whether it’s a “fat-finger” error, potential market manipulation, or a compliance breach.

3. Back-Office & Operations: Hyper-Automation & Efficiency

This is where AI delivers significant, tangible cost savings and operational efficiencies through Hyper-automation.

| Feature | Traditional CTRM(Pre-AI) | AI Enhanced CTRM(2026) |

| Document Processing | Manual data entry from invoices, bills of lading. | OCR + LLMs automate data extraction with near-perfect accuracy. |

| Logistics Optimization | Fixed routes and pre-scheduled transport. | Dynamic Route Optimization based on real-time weather, fuel costs, and port delays. |

| Trade Matching | Manual reconciliation of broker confirms. | Automated Matching and instant flagging of discrepancies. |

| Inventory Management | Periodic physical checks, manual updates. | Predictive Inventory levels based on real-time flow, demand signals, and supply chain events. |

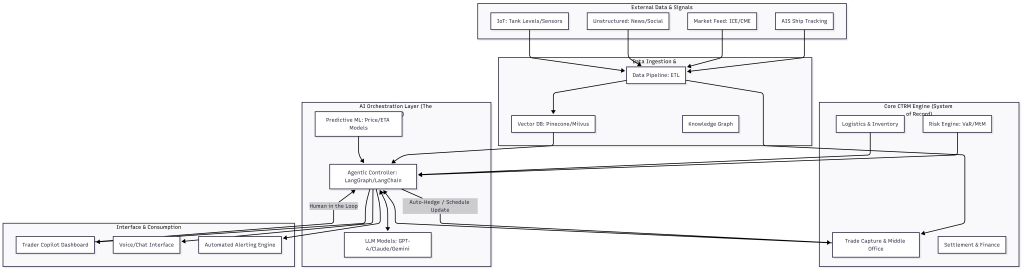

4. Integrating AI into Modern CTRM Architectures

Today’s CTRM platforms are evolving, adopting “headless” or “API-first” architectures designed to seamlessly integrate AI capabilities:

* AI Agents for CTRM: Imagine a sophisticated AI “agent” sitting on top of your CTRM. A trader could simply ask a voice assistant, “What is my exposure to Brent if the Suez Canal closes for three days?” The AI would query the CTRM, run the necessary simulations, and report back instantly.

* Automated Workflow Orchestration: AI can automatically trigger critical actions, such as initiating a margin call or executing a hedge, as soon as predefined risk thresholds are crossed, dramatically reducing latency and human error.

Your Strategy for an AI-Powered Future

If you’re considering integrating AI into your commodity trading operations, keep these pillars in mind:

* Data Readiness: AI thrives on data. Ensure your CTRM data is clean, centralized, and consistent to serve as a reliable “Golden Source.”

* Hybrid Cloud Approach: Many firms opt for a hybrid cloud strategy—keeping sensitive trade data on-premise while leveraging the power of cloud-based LLMs and AI services for broader market analysis.

* Build vs. Buy: While off-the-shelf AI modules are available for common tasks, developing proprietary AI models in-house can provide a unique competitive advantage and “alpha.”

The future of commodity trading isn’t just about managing risk; it’s about intelligently navigating complexity, anticipating change, and automating for efficiency. AI is not just a tool; it’s the co-pilot every modern commodity trading firm needs.