📊 5 Essential KPIs Every Physical Commodity Trader Should Monitor

In the world of physical commodity trading, success isn’t just about securing the best price—it’s about executing with precision.

To truly measure performance, traders must go beyond pricing and track real-time metrics that reflect risk, exposure, liquidity, and operational agility.

Here are five critical KPIs every trader should keep a close eye on—daily:

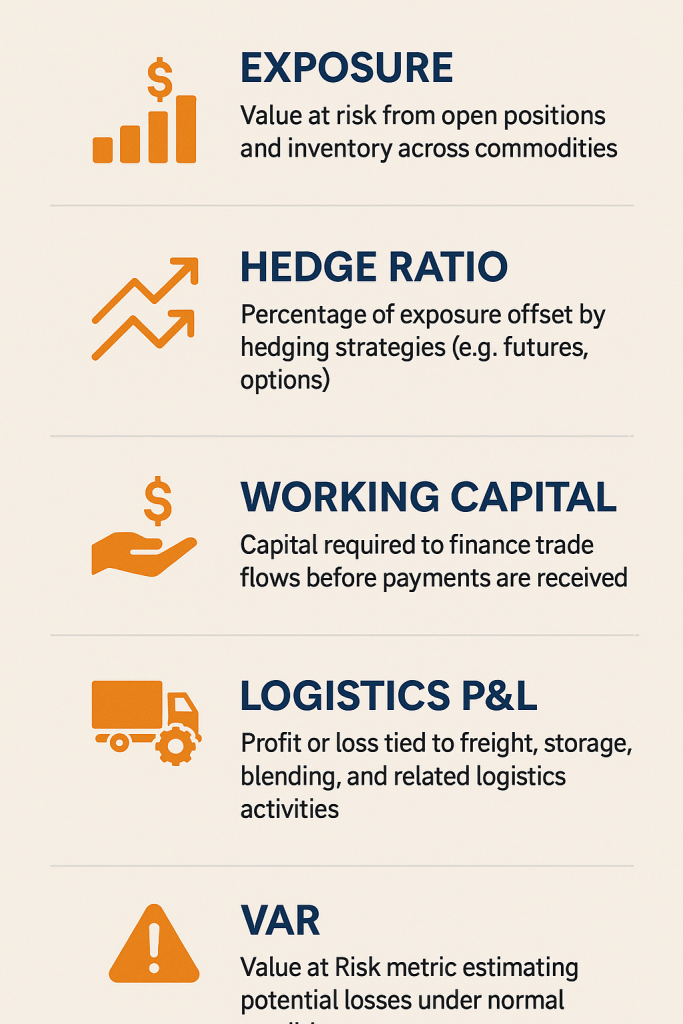

➡️ Exposure

→ Assesses the value at risk from open positions and inventory across various commodities.

➡️ Hedge Ratio

→ Indicates the proportion of exposure that’s mitigated using instruments like futures, swaps, or options.

➡️ Working Capital

→ Measures the liquidity required to maintain trade flows before receivables are collected.

➡️ Logistics P&L

→ Tracks gains or losses from freight, storage, blending, demurrage, and delivery timing.

➡️ Value at Risk (VaR)

→ Estimates potential losses under normal market conditions over a defined time horizon.

💡 These KPIs aren’t just financial metrics—they’re strategic tools that distinguish proactive professionals from reactive participants.