Not so long ago, I found myself grappling with Incoterms, bewildered by questions like, “Who pays?”, “Who ships?”, and “Who takes the risk?” It seemed daunting to navigate these international commercial terms that govern shipping agreements, but now they’re second nature. Working in trading & logistics, I’ve come to appreciate how choosing the right Incoterm can save time, money, and stress—and I’m here to share some insights.

What are Incoterms?

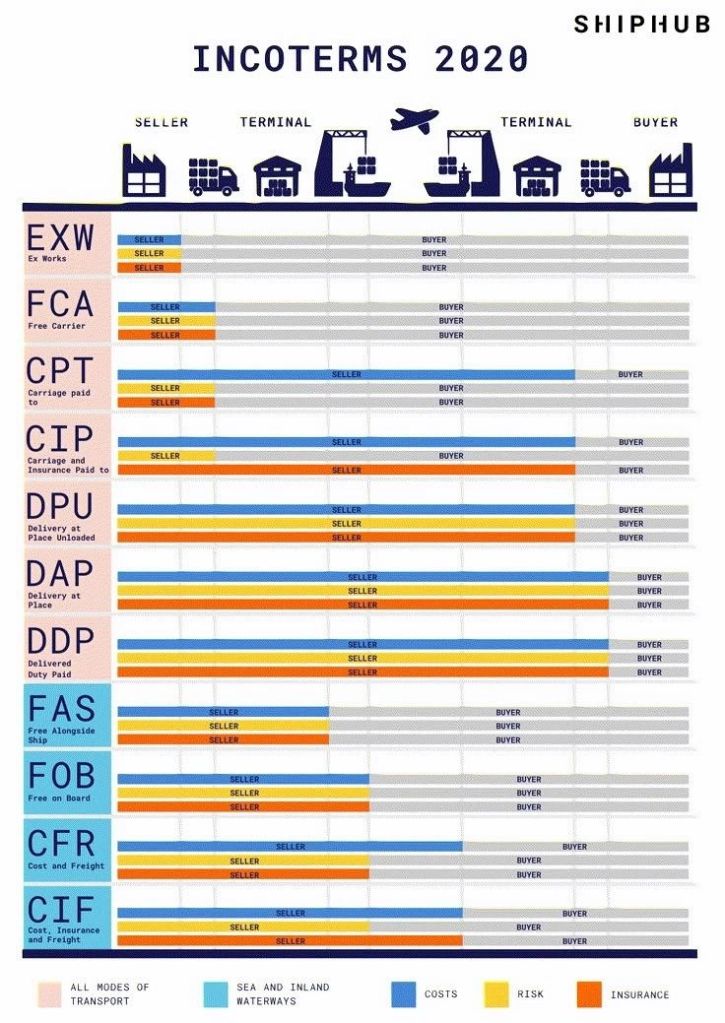

Incoterms, or International Commercial Terms, are standardized rules published by the International Chamber of Commerce (ICC) to clarify responsibilities between buyers and sellers in global trade. They specify who handles costs, who manages shipping arrangements, and where the transfer of risk occurs during the shipping process.

Your Handy Incoterm Guide

Here’s how I use them daily and what they mean in practical terms:

EXW (Ex Works)

The buyer does everything.

The seller makes goods available at their premises, and the buyer shoulders all responsibilities, from transportation to customs.

FCA (Free Carrier)

The seller drops at the first carrier.

The seller ensures delivery to a nominated location (like a shipping terminal), and the buyer handles everything from there.

CPT (Carriage Paid To)

The seller pays for transport, but risk shifts early.

The seller arranges and pays for shipping to a specified destination, but the buyer assumes risk once the goods are handed over to the carrier

CIP (Carriage & Insurance Paid To)

The seller pays for transport and insurance.

This is like CPT, but the seller adds insurance coverage for the buyer’s peace of mind.

DAP (Delivered At Place)

The seller ships, the buyer pays duties.

The seller delivers to an agreed location, with the buyer taking responsibility for customs and duties.

DPU (Delivered at Place Unloaded)

The seller even unloads the goods.

A step beyond DAP, the seller also takes care of unloading at the destination.

DDP (Delivered Duty Paid)

The seller pays all, and the buyer relaxes.

The seller covers everything—transport, duties, and taxes—offering maximum convenience for the buyer.

FAS (Free Alongside Ship)

The seller delivers near the ship, and the buyer loads.

The seller gets the goods alongside the vessel, and the buyer handles loading and beyond.

FOB (Free On Board)

The seller loads the ship, and the buyer takes over.

Risk and cost transfer once the goods are loaded onto the vessel.

CFR (Cost & Freight)

The seller pays freight, but the buyer takes the risk.

The seller covers transportation to the destination port, but risk passes to the buyer once goods are on board.

CIF (Cost, Insurance & Freight)

Like CFR, but the seller adds insurance.

This provides additional coverage for the buyer.

Making the Right Choice

The key to mastering Incoterms lies in understanding the balance between cost, control, and risk. For instance:

- If you want full control and minimal risk as a buyer, DDP might be your go-to.

- For a seller aiming to minimize obligations, EXW keeps responsibilities at a minimum.

- Meanwhile, CIP or CIF offers a middle ground with added insurance for buyer security.

By knowing your Incoterms, you can navigate logistics like a pro, cutting through confusion and streamlining your operations. So, the next time you’re shipping or receiving goods, remember: Incoterms are your allies in creating clarity and efficiency

What has your experience been with Incoterms? I’d love to hear your insights!